Understanding Hedging in Investment In the realm of finance, hedging is a critical risk management strategy adopted by investors and traders. The primary objective of hedging is to shield investments from potential losses that could result from adverse market conditions. By managing undesirable exposure, hedging serves as a form of financial protection, often likened to…

Month: September 2025

Dividend Investing: Trading Stocks for Passive Income

Understanding Dividend Investing Dividend investing is a well-regarded strategy within the financial realm, primarily centered on acquiring stocks that provide shareholders with regular dividends. These particular stocks serve as a mechanism for generating passive income, as companies typically distribute dividends on a quarterly, semi-annual, or annual basis. Investors looking for stability often gravitate toward dividend-paying…

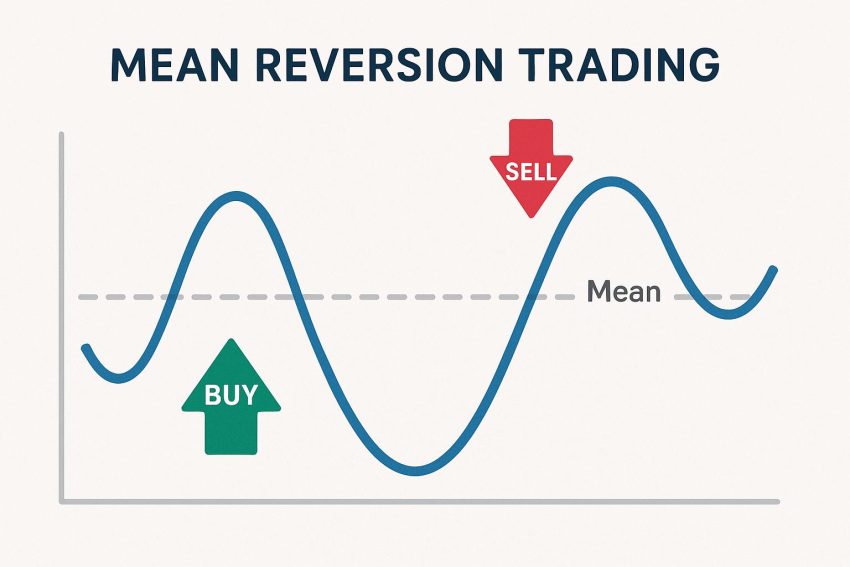

Mean Reversion Trading: Buying Low and Selling High

Understanding Mean Reversion Trading Mean reversion trading is a widely employed strategy in the world of financial trading, premised on the observation that the prices of financial instruments tend to oscillate around their average value over a specific period. This technique involves pinpointing securities whose prices have diverged from their historical average and making investment…