The Evolution of Trading: A New Landscape The world of trading has undergone significant transformations over the years. With the rapid advancements in technology, shifts in market dynamics, and globalization, trading has increasingly become an area driven by innovation and adaptability. This evolution in the trading landscape is characterized by the ever-growing integration of artificial…

Author: admin

Hedging Strategies: How Traders Protect Their Investments

Understanding Hedging in Investment In the realm of finance, hedging is a critical risk management strategy adopted by investors and traders. The primary objective of hedging is to shield investments from potential losses that could result from adverse market conditions. By managing undesirable exposure, hedging serves as a form of financial protection, often likened to…

Dividend Investing: Trading Stocks for Passive Income

Understanding Dividend Investing Dividend investing is a well-regarded strategy within the financial realm, primarily centered on acquiring stocks that provide shareholders with regular dividends. These particular stocks serve as a mechanism for generating passive income, as companies typically distribute dividends on a quarterly, semi-annual, or annual basis. Investors looking for stability often gravitate toward dividend-paying…

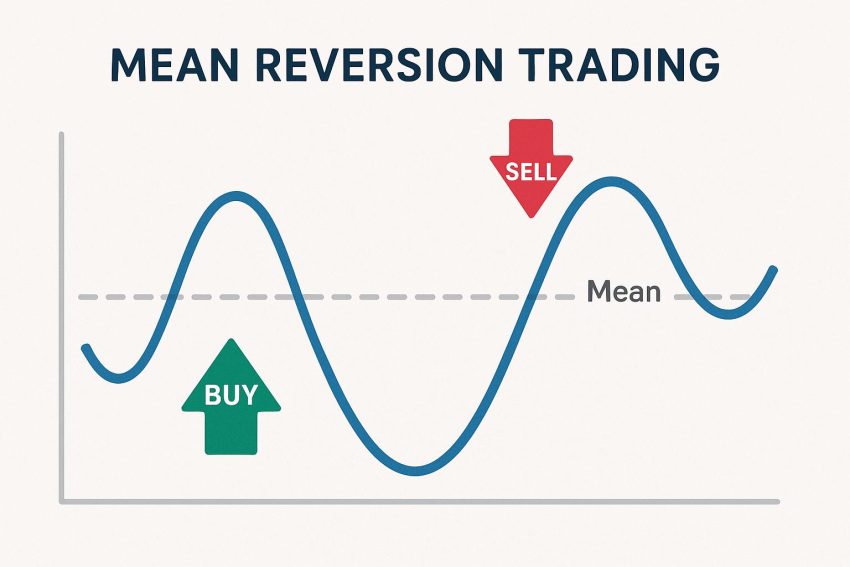

Mean Reversion Trading: Buying Low and Selling High

Understanding Mean Reversion Trading Mean reversion trading is a widely employed strategy in the world of financial trading, premised on the observation that the prices of financial instruments tend to oscillate around their average value over a specific period. This technique involves pinpointing securities whose prices have diverged from their historical average and making investment…

Breakout Trading: Identifying Key Market Movements

Understanding Breakout Trading Breakout trading stands as a cornerstone strategy within the realm of financial markets. This methodology has gained popularity due to its ability to assist traders in pinpointing pivotal market shifts. At its core, breakout trading involves initiating a position when the market price surpasses a predetermined level of support or resistance, possibly…

Momentum Trading: Capturing Price Trends for Profit

Understanding Momentum Trading Momentum trading is an investment strategy that focuses on capitalizing on the continuance of an existing trend in the market. Traders using this strategy aim to buy assets when they are on an upward trajectory and sell them when they are trending downward. This approach relies on the concept that assets demonstrating…

Pre-Market and After-Hours Trading: How It Works

Understanding Pre-Market and After-Hours Trading The world of stock trading extends beyond the regular trading hours of the stock exchanges. Pre-market and after-hours trading allows investors to buy and sell securities outside of the standard trading hours, which are typically from 9:30 AM to 4:00 PM Eastern Time for the New York Stock Exchange (NYSE)…

Dark Pool Trading: How Institutional Investors Trade Privately

Understanding Dark Pools Dark pools serve as private alternatives to traditional financial exchanges, allowing participants to trade large volumes of securities with a focus on confidentiality and minimal market impact. Predominantly utilized by institutional investors, dark pools have become a notable part of the modern trading landscape. The Mechanism of Dark Pools Dark pools are…

Arbitrage Trading: Profiting from Market Inefficiencies

Introduction to Arbitrage Trading Arbitrage trading stands as a highly regarded financial strategy aimed at leveraging discrepancies in asset prices across different markets, with the primary goal of generating risk-free profits. This strategic trade takes advantage of temporary inefficiencies within financial markets. In today’s rapid-paced trading environment, such inefficiencies are not uncommon, providing skilled traders…

Social Trading: How to Copy Experienced Traders

Understanding Social Trading Social trading is a modern approach to investment that allows individuals to follow, interact with, and copy the trades of experienced investors. This method provides access to the insights and strategies used by proficient traders, making it easier for beginners to participate in financial markets. The Basic Concept of Social Trading Social…